“In the past few months, SOLON SE had engaged in intensive efforts to carry out a financial restructuring. It held talks with investors, the financing banks and the guarantors. Today, the negotiations on an amicable solution failed. SOLON SE will now use the opportunities for a restructuring within the insolvency proceedings. An application for the opening of insolvency proceedings was subsequently filed for the following subsidiaries: SOLON Photovoltaik GmbH, SOLON Nord GmbH and SOLON Investments GmbH.” —Solon SE (S001) press statement

That was the short sweet announcement that Solon SE, Germany’s first photovoltaic panel producer listed on the stock exchange in 1998, was setting another milestone by filing for bankruptcy in German courts December 13, 2011 after its share price plummeted along with the falling fortunes of the once booming solar energy market.

The company laments that it was unable to overcome the perfect storm that is blowing solar companies onto the rocks. The elements of that perfect storm are well known. The politically correct push for ever more renewable energy driven by feed-in-tariff subsidies that created a feeding frenzy among producers of photovoltaic panels in Germany, Spain and elsewhere in Europe, but also attracted the attention of China eager to build its export capacity.

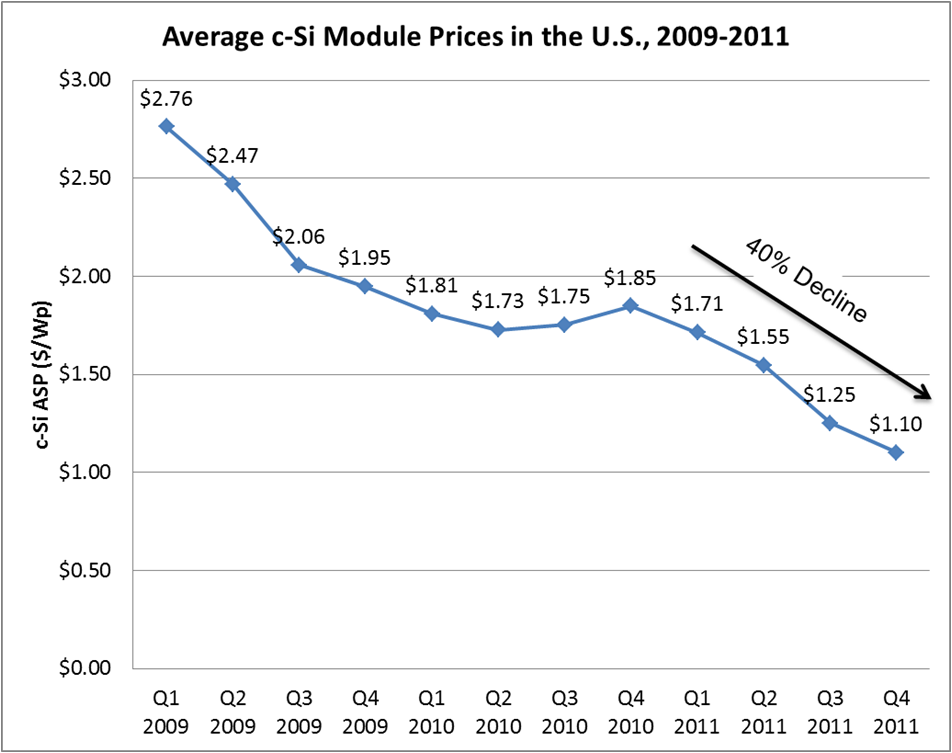

Overproduction of PV panels led to a glut in global markets, falling prices blamed mostly on China suctioned up the FiT subsidies to build market share for its export production and crashed the growth potential of domestic EU producers. Those producers responded by dumping panels thus driving down prices even further.

Generous but unsustainable feed in tariff subsidies created voracious demand for rooftop PV solar projects, so much so that the government funds for FiT subsidies were exhausted and so were the treasuries and debt limits of the EU governments.

In the end, Solon SE’s efforts to speed up cost cutting and extend the loan term were a futile effort to avoid a year end 2011 275 million-euro ($357 million) loan payment to Deutsche Bank AG and seven other German banks. Given the rest of the euro crisis embroiling the EU, the banks were in no mood or position to compromise. Checkmate.

Now the vultures are circling the green energy camp waiting for other weakened players to falter. Both Q-Cells SE (QCE) and Solarworld AG (SWV) are feverishly trying to avoid the same fate as demand for solar panels falls in Germany and debt payments loom. Conergy, another player at risk, swapped debt-for-equity in a recent transaction which turns over control to hedge funds Sothic Capital and York.

Solar Industry Rationalization is at Autobahn Speeds . Share prices of other solar players also fell sharply with Solon SE’s bankruptcy filing. Part of the reason, apart from the overall economic uncertainties, is that feed-in tariff in Germany in January 2012 drop to 23-24 euro cents per kilowatt hour for large roof-top installations roughly the same level as consumer power prices. This is a radical change from the heady days when large FiT subsidies made solar extremely attractive to consumers since those big subsidies guarantees a solar power price for 20 years. Italy’s solar feed-in-tariffs have also fallen to 25-27 euro cents per KWh and are today modestly above the country’s grid price. Solar prices are at near grid parity in Spain and other countries are racing to get there. Britain had FiT subsidies almost two times higher than Germany but those supports are being cut in half to reflect the unsustainability of the payments by governments and changing market conditions. US solar markets face the expiration of the 1603 Treasury grants and the discredited DOE loan guarantee program this year and a fight to keep production tax credits and investment tax credits next year.

Profitable margins or not, solar energy is reaching grid parity pricing in the EU. While it has been a fast painful decline and a death spiral for some, those that survive hope to find a mature, healthier and more sustainable market future.

This rationalizing of the overheated solar market is also finally coming home to roost in China. Press reports in China’s Guangzhou Daily say about 50% China’s solar PV producers have stopped production, 30% cut output in half while only 20% are trying to maintain production. Digitimes Research and CSG Holding’s press reports say only the top tier PV producers in China have production rates over 80% of capacity. But even those cutbacks could still keep an oversupplied market awash in panels for some time.

Germany has been one of the world’s largest and most robust markets for solar PV panels so the falling dominoes in Germany are clear evidence that the shakeout in the solar industry is accelerating. China will also have to change its strategies to maintain its export growth perhaps picking up the slack from falling FiT subsidies by offering financing terms for China exports to keep production up or investing in surviving solar companies or projects around the world. Either strategy is likely to produce more sustainable results and, at least, align the incentives of the market players to reduce the boom and bust market ride.

Related articles

- Consolidation might rise as solar industry saviour (business.financialpost.com)

- Burned by solar (business.financialpost.com)

- Solar Energy Worry List (insightadvisor.wordpress.com)

- Judge orders urgent hearing over solar subsidy cuts (guardian.co.uk)

- Grid Parity Reality Hits Home for Renewable Energy (insightadvisor.wordpress.com)

- German solar firms go from boom to bust (business.financialpost.com)

- Which Way Will Solar Energy Go? (insightadvisor.wordpress.com)

- German solar maker Solon hits the skids (news.cnet.com)

- German solar firms go from boom to bust (business.financialpost.com)

Well……

Where are your clothes made, Gary?

It’s virtually CERTAIN that they’re not made in the US. They most like are made in China… and if you are lucky, Mexico or Central America….

Doesn’t mean that you should stop wearing clothes – because almost all cloth and clothes makers were run out of business in the US.

The problem hitting Solar has hit a LOT of different technologies and industries.

******

The old traditional Utility model of power – and the old traditional US/European business models are just NOT going to be effective in the future…